The ever-changing business landscape brings both opportunities and challenges. The level of risk that businesses face from industry dynamics, economic uncertainty, swings in interest rates, changes to government policy, or any number of other factors may feel elevated after the past few years. Navigating these challenges can feel overwhelming for even well-equipped business leaders.

Fortunately, enterprise risk management (ERM) can help leaders more effectively prepare for and mitigate risks while also positioning for new opportunities. ERM is not about stopping or slowing down progress. It is centered around understanding threats to a corporation’s strategy, then working with stakeholders to understand and overcome impediments to the company’s goals.

In fact, a primary risk that must be managed is opportunity risk — the risk of inaction. Many companies may choose to continue to use old technologies or processes because of their familiarity without considering the risk of their inaction. For example, failing to adopt a new and improved customer relationship management system could result in higher customer attrition. While there may be a cost to investing in technology and training, the cost of lost business can be far greater.

The role of enterprise risk management across people, processes and systems

ERM takes a holistic view of a business and helps to manage risks that are shared across verticals or workstreams. In many cases, these risks may be beyond normal, day-to-day operations and thus may be missed by individuals with visibility of only one part of a business. As a result, ERM can help companies more accurately understand and overcome risks to their strategic goals.

There are three key parts of effective ERM that reinforce one another: people, processes and systems. ERM is about having the right people to complete a job and operate within processes that ultimately feed into a system. Managing risks is an ongoing process that should be applied across all levels of an organization. It requires communication and collaboration to ensure employees aligned about how to manage potential risks. Combined, having the right people, processes and systems can help businesses manage and mitigate risks, while also enhancing their ability to take advantage of opportunities.

In order to develop an ERM system, it’s important to pay attention to three key areas. First, organizations need proactive processes to manage change. For example, in the wake of the COVID-19 pandemic, business leaders who were able to actively search for opportunities created by federal aid programs were more likely to successfully adapt to rapidly changing conditions.

Second, strong ERM requires a culture of transparency and buy-in from all employees. Cultivating buy-in from employees can help business leaders proactively detect and understand threats to their strategic goals. Without the communication and knowledge surrounding a challenge, businesses cannot adapt.

Third, there needs to be an appetite to see strategies and goals to completion. Organizations that fail to complete strategic initiatives will struggle to evaluate their previous successes and failures, which can weaken their positioning moving forward. Beyond each of these items, a strong culture must be developed to enhance these behaviors across the business.

Enterprise risk management in practice

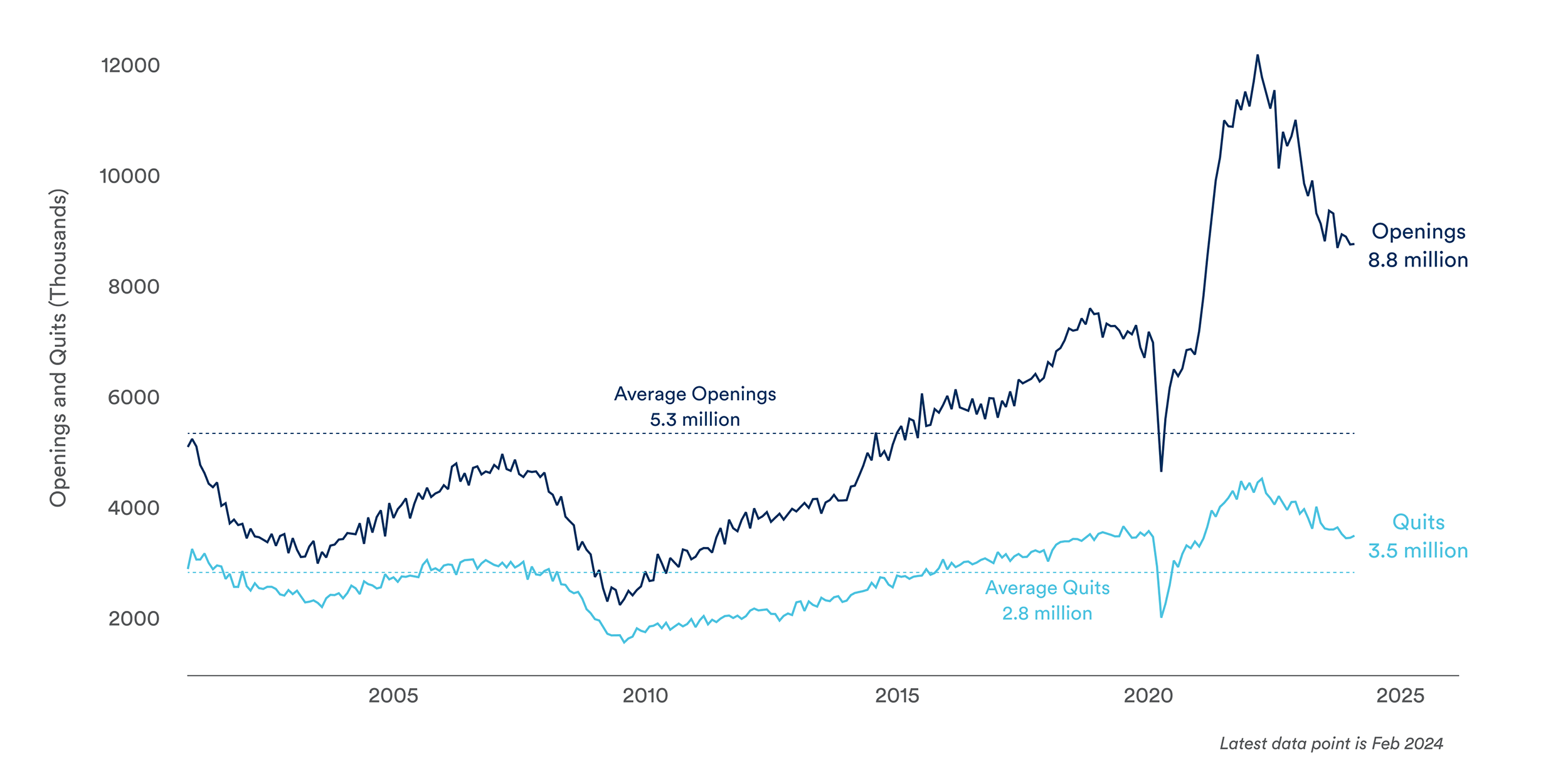

Job openings and quits1

The last few years have emphasized the need for effective ERM. For example, hiring qualified workers has become increasingly competitive as the economy has rebounded from the pandemic and continued to grow steadily. Companies with good people and processes in place have likely been in a stronger position to weather these challenges. This is because investing in education and a strong culture can reduce employee attrition, while having a clear organizational structure and outlined roles and responsibilities can help keep a business running when attrition does occur.

More broadly, organizations can learn several lessons from how they and other businesses reacted to the pandemic. First, risks are unavoidable. The pandemic was unpredictable and no business leader could have adequately prepared for its effect on our economy. However, planning and preparation helped to mitigate many of the risks that came to the forefront. The correct people, processes and systems allowed many businesses to successfully transfer their operations from in-person to online at breakneck speed, or to adjust production schedules while implementing safety measures.

The cost of inaction during this period was also high. Failing to adapt to the changing business environment after the economy reopened would have left many businesses unprepared to take advantage of the strong economic rebound.

The same is true as businesses adapted to rapidly changing financial conditions. For example, a firm with strong risk management and a willingness to take appropriate risks may have capitalized on low interest rates following the pandemic and stronger-than-expected demand to improve their business. In contrast, waiting for the economy to stabilize before implementing a strategy would have left businesses with fewer options.

Interest rates in perspective2

The risks and challenges of recent years have also highlighted the importance of having active partners and advisors in order to best respond to unforeseen situations. Regular touch points and reviews with banking partners can position your business to handle unexpected challenges. After all, partners are best suited to support businesses when they are aware of business leaders’ strategic goals ahead of time, so that decisive action can be taken when conditions change.

Ultimately, evaluating and managing risks are key parts of developing a strategic plan. While risks are not always predictable, developing a strong culture based around ERM through people, processes and systems can help businesses successfully respond to both anticipated and unexpected challenges.